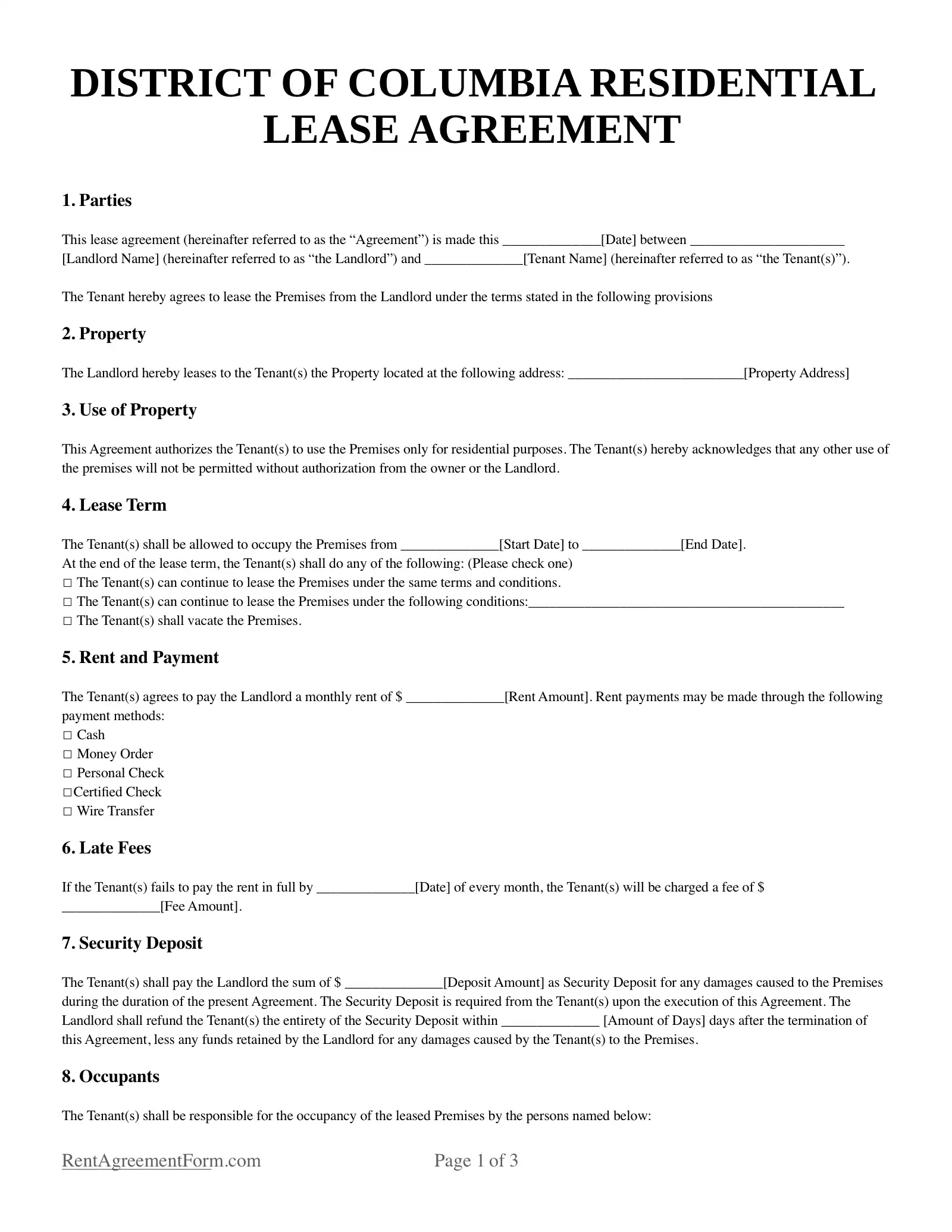

Washington, D.C. Residential Lease Agreement Form

Are you interested in leasing property in Washington, D.C.? Before moving in, you must sign a residential lease agreement form. It is a contract between a landlord and tenant regarding the rent of a room or home that may be a separate house or part of a multi-family building.

The landlord and tenant must discuss the contents of the form. A standard lease agreement contains brief descriptions of the property, such as the address, size, and type of structure. Other necessary information includes the names of all occupants plus pets if there are any.

Lease details are important parts of the agreement too. It should mention the monthly rent and its due date. In most cases, rent is due on the first of every month, but the landlord and tenant can agree on their own terms. In the same manner, both parties can agree on their responsibilities as landlord and tenant.

Residential lease agreement forms usually hold the landlord responsible for ensuring that the property is safe for occupancy. The tenant, on the other hand, must pay rent on time as well as ensure that the property will remain in good condition until the end of their tenancy.

For utmost convenience and reference, we offer fillable and printable Washington, D.C. residential lease agreement forms available online.

Required Disclosure:

- Lead-Based Paint Disclosure Rule. Realtors and landlords are required to disclose to the tenant if the rental unit was built before 1978. Properties built before then usually have lead-based paint, which is hazardous to human health. Hence, the landlord must provide the tenant with resources about its dangers (Lead-Based Paint Hazard Reduction Act of 1992 § 1018).

- D.C. Disclosure on Rent Increases. The tenant has the right to know about possible increases in rent charges. From the moment a prospective tenant submits a rental application, there should already be a rent disclosure form published by the rent administrator (DC Code § 42–3502.22).

- Notice of Tenant Rights. The tenant must know about circumstances affecting the real estate or rental unit. For example, if there are pending petitions that could break or hinder one’s peaceful accommodation, then they must be disclosed to the tenant (Department of Housing and Community Development).

- Voter Registration Form. This is one of the more unique regulations in Washington, D.C. It stipulates landlords should provide tenants with updated voter registration forms. Copies of these forms can be requested from the Board of Elections (D.C. Law 23-112).

Rent Grace Period

Washington, D.C. provides a five-day grace period for tenants. This means that if the tenant fails to pay rent on the due date, the landlord cannot proceed with the eviction process unless the tenant maintains an unpaid rent balance for longer than five days.

State law also maintains provisions for late fees: “A housing provider may charge a late fee of no more than 5% of the full amount of rent due by a tenant” (DC Code § 42–3505.31).

However, late fees can only be charged if it is mentioned in the lease agreement and once the grace period is over.

Security Deposits

A Washington, D.C. landlord can charge a maximum security deposit equivalent to one month’s worth of rent. Unlike the rental application fee, the security deposit is refundable.

However, the landlord has the right to withhold some amount from the security deposit in case of damage to the property. If this happens, the tenant must be informed of the withheld amount. They must also receive an itemized list of the deductions made from the deposit.

Finally, the remaining balance must be refunded to the tenant within 30 days (DC Code § 42–3502.17).